Table of Contents

When considering diverse investment opportunities, it is essential to examine the unique potential offered by tube investments. Not only do present a viable option for diversifying one’s portfolio, but they also provide a steady growth potential that appeals to both seasoned and novice investors. Furthermore, understanding the nuances of can significantly enhance your ability to make informed financial decisions, especially in an ever-evolving market.

What Are Tube Investments?

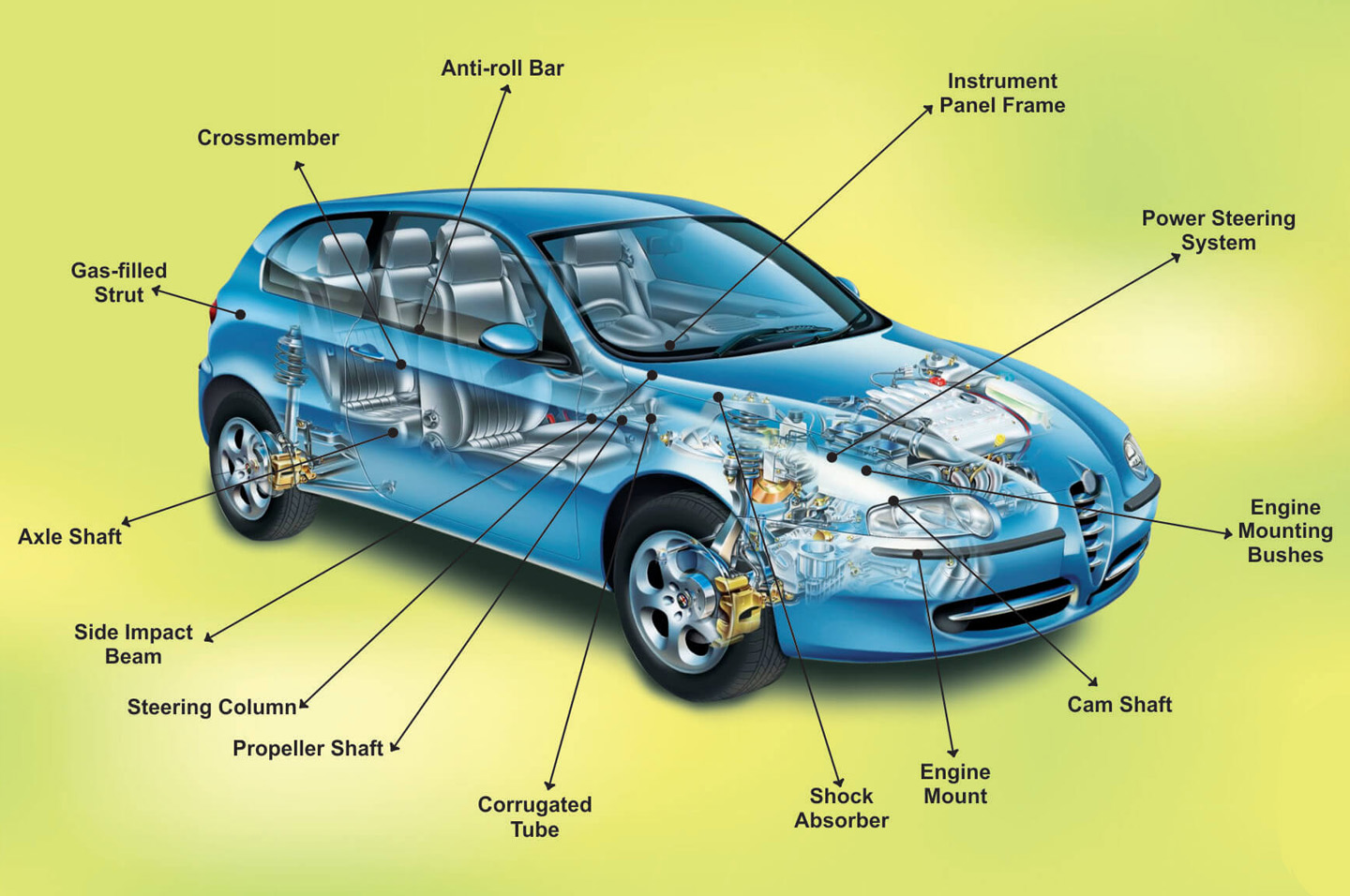

To begin with, it is crucial to understand what entail. Essentially, refer to investments in companies that specialize in the manufacturing and distribution of tubes and related products. These companies often operate in sectors such as automotive, construction, and industrial manufacturing, where tubes play a critical role in various applications. Moreover, because these products are fundamental to numerous industries, can offer a stable and reliable return over time.

Why Consider Tube Investments?

Given the importance of tubes in various industries, have the potential to be a lucrative addition to your investment portfolio. Not only do these companies typically have consistent demand for their products, but they also benefit from long-term contracts with major corporations. As a result, investing in tube manufacturing companies can provide a steady income stream. Additionally, because tube investments are tied to essential industries, they may offer a certain level of resilience against market volatility.

How to Identify Promising Tube Investment Opportunities?

Identifying promising requires careful analysis and research. For instance, one should consider the financial health of the company, its market position, and its growth prospects. Moreover, looking at the company’s track record in terms of revenue growth and profitability can give you insight into its potential for future success. Furthermore, understanding the broader industry trends, such as advancements in technology or changes in regulatory environments, can help you identify companies that are well-positioned to capitalize on these changes.

The Benefits of Diversifying with Tube Investments

In addition to their growth potential, offer significant diversification benefits. By including tube investments in your portfolio, you can spread your risk across different sectors, thereby reducing the impact of any single market downturn. Moreover, because are often tied to industries that are essential to the economy, they can provide a buffer during periods of economic uncertainty. Consequently, diversification with can contribute to a more balanced and resilient investment strategy.

Strategies for Maximizing Returns from Tube Investments

To maximize returns from , it is important to adopt a strategic approach. Firstly, consider investing in companies that have a strong competitive advantage, whether it be through innovation, cost efficiency, or market share. Additionally, it is advisable to monitor industry trends and stay informed about potential disruptions that could affect the tube manufacturing sector. Furthermore, regularly reviewing your investment portfolio and making adjustments as needed can help you stay aligned with your financial goals.

Conclusion: Making Informed Decisions with Tube Investments

In conclusion, tube investments represent a compelling opportunity for investors looking to diversify their portfolios and achieve steady growth. By understanding the key factors that influence the success of tube manufacturing companies, you can make more informed investment decisions. Moreover, by incorporating tube investments into a diversified portfolio, you can enhance your overall investment strategy and potentially achieve more consistent returns. Ultimately, staying informed and proactive in your approach to tube investments can lead to long-term financial success SRTS News.